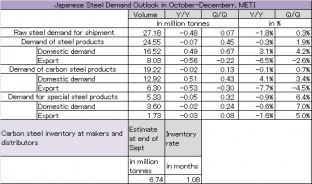

Japanese raw steel demand will increase by 0.3% to 27.18 million tonnes in October-December from estimated production in July-September, which increases for 2 quarters in a row, announced by Ministry of Economy, Trade and Industry on Thursday. The demand increases marginally due to lower export under high yen rate while the domestic demand increases for automobile and civil works related to the rebuilding activity of damage by the major earthquake. The lower growth is partly due to high inventory. METI warns the demand could decrease depending on domestic automobile production after the immediate production increase and potential lower export under uncertainty in international economy.

The domestic demand of steel products increases by 0.7% to 12.92 million tonnes in October-December from July-September. The demand for civil works increases by 19.1% to 1.41 million tonnes when the government spends around 2 trillion yen for construction out of 4 trillion yen of first extra budget for fiscal 2011 ending March 2012. The domestic steel demand is 7.3% lower than same period of 2010 due to lower government investment for regular budget. The building steel demand is 3.57 million tonnes, which is 2.6% lower than July-September due to seasonally lower nonresidential building activity and 4.9% higher than same period of 2010 due to better housing activity. The automotive steel demand is 3.05 million tonnes, which is 6.2% higher than July-September and 13.4% higher than same period of 2010 when automakers increase the production after the production cut caused by the major earthquake. The steel export decreases by 2.6% to 8.03 million tonnes in October-December from July-September, which decreases for the first time in 2 quarters due to higher Chinese production, lower international steel price and higher yen rate. The special steel export increases by 6.4% while the carbon steel export decreases by 2.6%. METI expects Japanese steel industry focuses on inventory adjustment under recovering manufacturers’ steel consumption while the inventory increased under slower demand. METI also watches carbon steel import after the volume increased by 12.4% to 1.51 million tonnes in April-July from same period of 2010. METI warns domestic steel makers should observe each demand area carefully when automakers could reduce the output after the immediate increase to fill the inventory and the government would spend more for construction after the authorization of third extra budget.| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| « Jan | ||||||

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

Japan Steel Scrap Composite Prices (Sangyo Press)

2026/02/04| H2 | NewCutting (PRESS) |

| 43700YEN (-) | 46000YEN (-) |

| 282.66US$ (-0.57) | 297.54US$ (-0.6) |

* Average of electric furnaces steel maker's purchasing price in Tokyo, Osaka and Nagoya (per ton)

- JMB Tieup company

- The Korea Metal Journal

- ferro-alloys.com

- Steel on the net

- AMM

- MEPS